Setting your wedding budget is no easy task. From wedding dress and bridal party clothing to fabulous food, photographer, highly recommended entertainment, cars, cake…the list goes on. Your wedding’s likely to be the biggest, most expensive party you’ve ever hosted! Even if you don’t want all these things, or you’re planning an intimate micro-wedding, the costs can soon build up.

But whether you’re working with an overall budget of £1,000 or £50,000, our Sean has some useful suggestions to help.

Crunch your numbers

The funds available for your wedding budget will depend on:

- How much you earn.

- What you can (jointly and individually) afford to set aside each payday.

- Any savings you already have.

- Any financial contributions you may receive to help pay for your wedding.

It’s always worth starting with an open discussion about all areas of your finances, including any savings you each already have. How much of this money are you each willing to put towards your wedding day? Whilst you might be tempted to throw it all in, that might not be the best approach. Other commitments, such as saving up for a home deposit might make it advisable to keep some of that money separate for unexpected bills and any unforeseen emergencies.

But whilst we all have fixed costs we can’t avoid – like the mortgage or rent – we sometimes manage to spend a surprising amount of money on ‘throw away’ or ‘luxury’ items. These little treats can soon add up and now’s the time to maybe look instead at spending that cash on some bigger treats for your wedding.

To get started:

- Look at your take home pay each month, take out all of your fixed costs and then see what’s left over.

- Next, consider how much you might be able to save from this each month – with your wedding timeline in mind. For instance, if you’re planning to marry in 18 months and you are able to save £600 a month between both of you, then you might manage to save an extra £10,800.

- Then, to create a workable budget for your wedding, create a spreadsheet or use a notebook, to record everything. This will help ensure you identify costs and stick to your budget throughout your planning process.

- Don’t forget to include a contingency budget to cover any unexpected costs.

Finally, once you’re busy saving and spending in the run up to the big day, be prepared to adjust planned spending. These are likely to be the cuts and compromises which will help you stick to that budget. Yes, it’s hard work but putting in the time and energy now will help you have a wedding budget you can actually stick to.

Will you be gifted any money to help with costs?

Do you have any family members who may have been putting money aside towards your wedding costs? Perhaps there’s someone who would like to pay for something specific for your wedding day?

Family help could potentially be a massive bonus for you and really help with a key cost. Yes, these conversations can be awkward, but perhaps a grandparent has always dreamed of buying your wedding dress?

If family are shy about just handing over cash (and you’re shy of asking) there’s another solution! Wedding gift vouchers from your chosen providers can be a useful option – especially if you have chosen your providers. Such vouchers can be ideal for birthday and Christmas presents in the run up to the wedding too and can help take care of some of the costs for you.

Track your spending

- Once quotes come in, you’ll be able to fill in the Modified column and begin to see whether you’re likely to come in around the budget you had in mind or whether you were way off.

- The final amount you pay will go in your actual spend column (just don’t forget to include any deposits you pay along the way too)!

- Keep your spreadsheet as updated as you can, and change any estimates as soon as you have more accurate quotes. Start with your biggest costs such as your venue and any outside catering. Also check you’ve received accurate quotes by asking if VAT or any extra gratuities are included in the quote.

Unexpected spends arising? That’s where your contingency budget comes in, to cover any items you may have forgotten or extras you decide you’d like later down the line.

Find ways to save

Change your venue – usually one of the most expensive costs. Blank canvases feel like a steal at the time but costs can add up when hiring everything in. There’s usually money to be saved on your venue whether it’s hiring a smaller space or going for a package deal – be venue savvy from the off and your budget will thank you.

Go off peak – having a midweek wedding or a date that’s out of the late Spring/Summer period will also come with more reasonable rates. Winter weddings have a magic of their own and often guests can come because there’sno clash with their summer holidays!

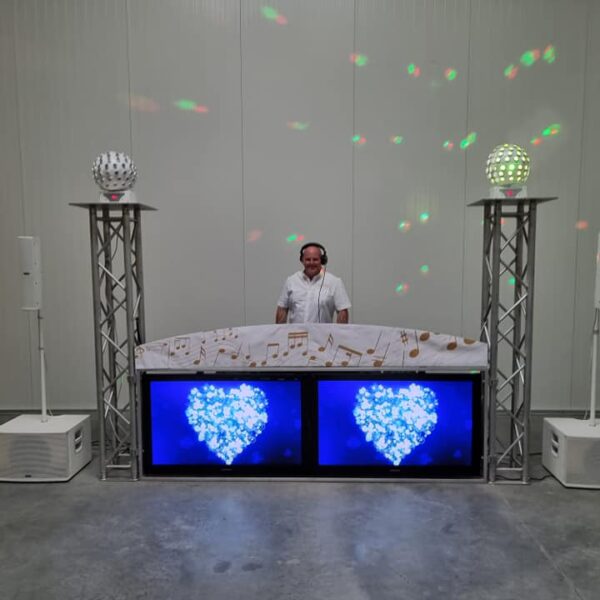

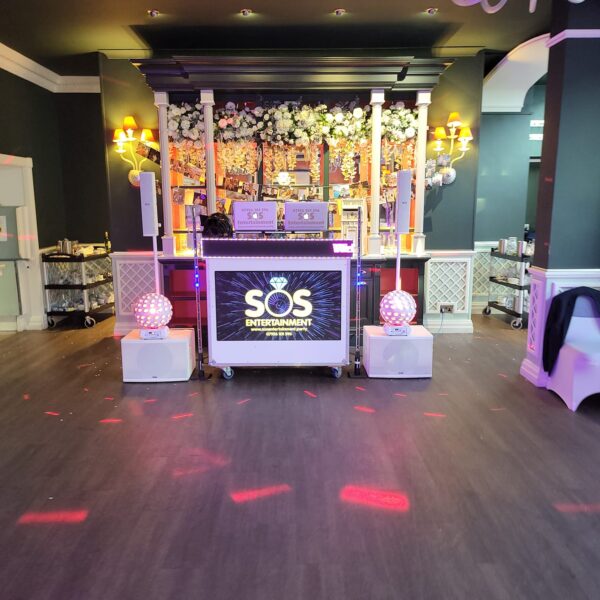

Check out reputable providers who work together, to see if this can bring down costs. Sean works with a range of venues and other suppliers and can organise entertainment packages with other providers, to help bring down some costs.

Have a longer engagement – this gives you more time to save and have those extras you’ve always dreamed of.

Ask questions when you’re talking to providers. Sometimes they might have just what you want or have suggestions about extras and can add it into the quote for your wedding – just like Sean does when creating bespoke wedding bundles. Always consider the value for money that package pricing brings – you’re not paying the time and transport costs for separate providers but instead one provider (plus team) can organise it all. This can also mean less hassle and phone calls too, as you’re dealing with one professional instead of seven!

Have the ceremony and reception in the same place and cut transportation costs.

Keep that contingency pot going! The idea is to only use it when you absolutely have to, but it helps to stop you from going over budget.

Don’t make impulse purchases – have a clear plan for what you want so that you avoid those impulse purchases that can often cost more than just their price tag.

And remember, it’s not about how much money you spend but it’s about how much love and joy you feel. At the end of the day even if you get married for £100 in a simple dress or suit it can still be an incredibly beautiful, meaningful and memorable day.